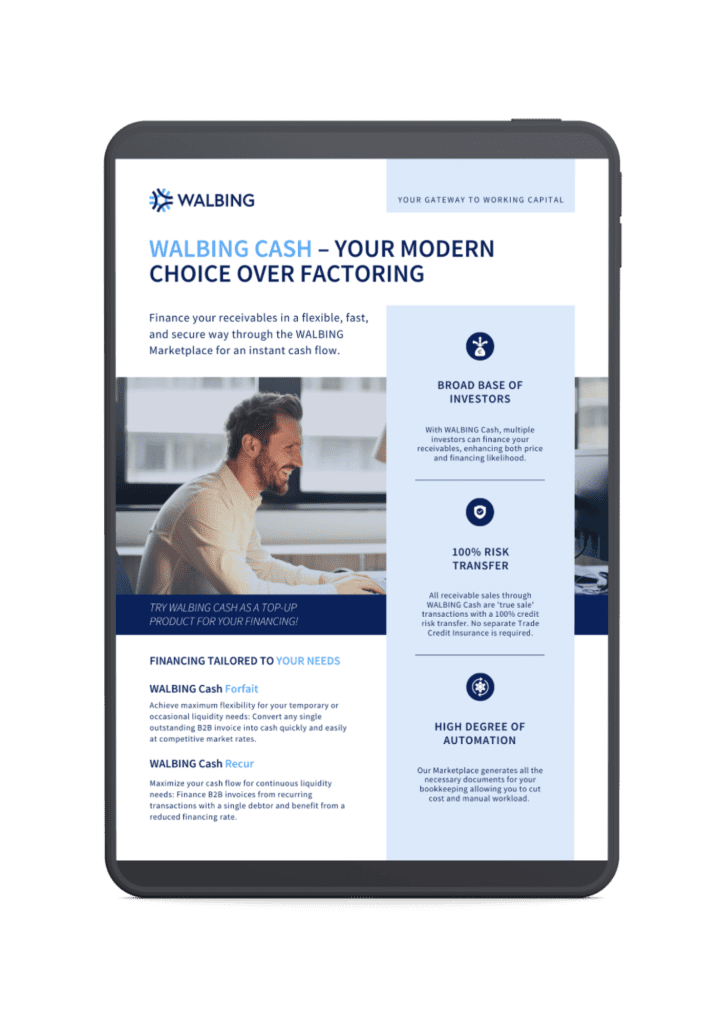

PRODUCT

Finance receivables

with WALBING Cash

Boost liquidity and working capital, improve cash flow, and eliminate credit risk: Sell your B2B receivables quickly and easily at the WALBING Marketplace.

Trusted by

Flexible cash flow

WALBING Cash Forfait

Achieve maximum flexibility for your temporary or occasional liquidity needs: Convert any single outstanding B2B invoice into cash quickly and easily at competitive market rates.

- Selective ad hoc financing tailored to your liquidity needs.

- Ideal for one-time or irregular accounts.

- Unmatched flexibility and speed.

WALBING Cash Recur

Maximize your cash flow for continuous liquidity needs: Finance B2B invoices from recurring transactions with a single debtor and benefit from a reduced financing rate.

- Financing of recurring invoices with the same debtor.

- Ideal for revolving accounts and subscriptions.

- Reduced financing rate applies as a reward.

Your benefits with WALBING Cash

With its unmatched flexibility and speed surpassing that of banks and traditional factoring providers, our B2B receivable financing solution is tailored specifically to the needs of the mid-cap market.

Quick access to liquidity

Submit your invoice for sale and get financed within 24 hours

Credit risk transfer

All invoice sales are ‘true sale’ with 100% credit risk transfer

Transparent pricing

Clear pricing with no hidden fees at competitive market rates

No additional securities

Your invoice serves

as the sole

security

Easy

to use

Simple & quick invoice upload, user-friendly interface

Transparent and reliable receivable financing

High speed, low risk

All financing transactions are subject to 10% retention to maintain a low-risk environment. This approach ensures that receivable sellers can quickly access liquidity while allowing buyers to make swift financing decisions.

Fair business practices

We work with disclosed assignments only to nurture trust in business relationships. There are no surprises with WALBING Cash as all transaction parties are always best informed about the status of their payments and funds.

Fast funds, no fuss

With no framework agreement, no maximum financing limits, and no TCI requirement, WALBING Cash allows you to finance with ease and reduces your admin work, providing all the necessary documents for your bookkeeping.

Four steps to liquidity

Sign up

Sign up for the WALBING Marketplace: We'll verify your data and run a KYC check.

Upload receivables

Upload your invoice manually or with the help of our Excel/XML templates.

Sell and get paid

Define sales parameters and preview your payout amount. Get paid within 24 h after the sale.

Track and report

Stay on top of your sales with our dashboard and automatically generated documentation.

Four steps to liquidity

Sign up

Sign up for the WALBING Marketplace: We'll verify your data and run a KYC check.

Upload receivables

Upload your invoice manually or with the help of our Excel/XML templates.

Sell and get paid

Define sales parameters an preview your payout amount. Get paid within 24 h after the sale.

Track and report

Stay on top of all your sales with our dashboard and automatically generated documents.

Pricing

Fee structure

-

Monthly base fee:

-

Seller KYC-Fee:

-

Debtor fee:

-

Collection fee:

-

Service fee:

-

Interest rate:

WALBING Cash

-

-

-

-

-

< 1%*

-

3.5% p.a. (+ Euribor/SOFR)

Traditional factoring

-

-

-

-

-

< 1%*

-

> 3.5% p.a. (+ Euribor/SOFR)

* Receivables with 30-day payment terms.

Pricing

WALBING Cash

vs.

Traditional Factoring

Monthly base fee

- WALBING Cash

- Traditional factoring

Seller onboarding/KYC fee

- WALBING Cash

- Traditional factoring

Debtor onboarding fee

- WALBING Cash

- Traditional factoring

Collection fee

- WALBING Cash

- Traditional factoring

Collection fee

- 1%*

- 1%*

INTEREST RATE

- 3.5% p.a. (+ Euribor/SOFR)

- 3.5% p.a. (+ Euribor/SOFR)

* Receivables with 30-day payment terms.

- Authorized and monitored as payment service by the German Federal Financial Supervisory Authority (BaFin)

- Our FinTech is 100% internally developed

- Our service contracts have proven their quality and reliability to investors and DAX-listed companies

- High KYC/AML standards

- Licensed collector