The Challenge

Metalshub embarked on a quest to find an ideal Embedded Finance partner to help orchestrate capital for its supplier base. Recognising the distinct challenges of its customer industries, such as high-value transactions, production-related liquidity cycles, and the cyclical nature of their operations, Metalshub sought to elevate the financial support available to its suppliers by providing receivable financing (forfaiting) directly through its software.

Metalshub’s Requirements

One-click receivable financing

Availble in the Metalshub’s UI

Seamless integration

Single API integration of receivable financing into the Metalshub’s software

Financial information

Instant visibility of financing rates and discounts based on the buyer rating

Partner pricing for forfaiting

Fixed financing rates for Metalshub’s suppliers through partnership

Quick liquidity for suppliers

Swift payouts for accelerted transactions

The Result

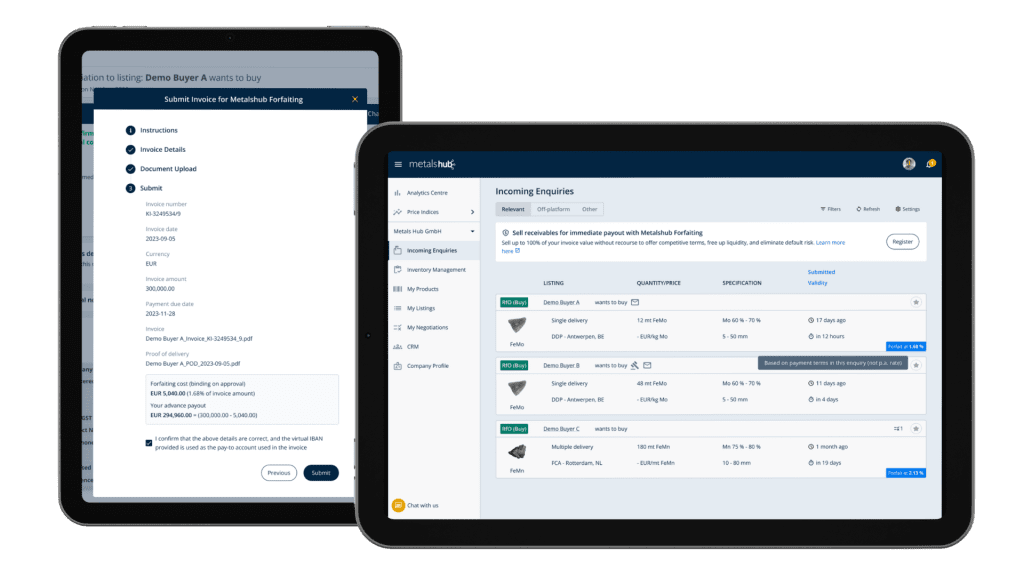

WALBING Cash Embed integration has seamlessly connected Metalshub’s software to the WALBING’s large pool of institutional investors seeking to acquire receivable assets.

By having instant access to trade finance instruments through Embedded Finance, Metalshub suppliers can now finance individual transactions with buyers who fall outside their existing credit coverage, all while safeguarding their liquidity. The suppliers’ del credere risk is entirely eliminated as all WALBING receivable sales are true sale.

Dr. Sebastian Kreft

Co-Founder & Managing Director

Metalshub

With Walbing, we have the best-in-class Embedded Finance partner to enable our sellers to forfait their receivables at a discount for immediate risk relief and

cash payment.

While the suppliers receive a payout in less than three days, buyers enjoy competitive payment terms that align with their production cycles. The entire forfaiting process is carried out within the Metalshub’s user interface, resulting in a significant reduction in workload and cost associated with traditional trade finance instruments.

What’s in it for Metalshub and its customers?

Metalshub:

- Higher conversion thanks to better

terms for the suppliers and buyers - Improved customer loyalty

- Commission earnings

- Additional USP for new business

Metalshub’s suppliers and buyers:

- Convenience of a one-stop-shop

- Instant liquidity & working capital

- 100% credit risk elimination

- No need for Trade Credit Insurance or additional credit coverage

- Frictionless transactions

With a WALBING Cash Embed integration, Metalshub now operates with the agility of a fintech platform, without the hassle that often accompanies finance operations.

WALBING takes care of all legal requirements, licenses, funding partnerships, and software. The automated processes further enhance the efficiency of transactions within the trusted ecosystem, reducing friction, improving customer experience and retention, and adding to the Metalshub’s revenues through commissions earned with every transaction.