When it comes to investing in trade receivables, wouldn’t it be incredible to have an automated assistant helping optimize your investment decision-making? That’s exactly what WALBING’s ALFA (ALgorithmic FActoring bot) offers on our cutting-edge receivable financing marketplace, putting an end to tons of manual work that is often associated with investment in trade receivables.

ALFA is a game-changing, fully automated bot designed to serve investors in the alternative asset space. By using advanced algorithms, ALFA analyzes data from our marketplace, your investment requirements and makes corresponding receivable purchases, unlocking a whole new level of efficiency, diversification, and profitability. Let’s make a deeper dive into ALFA’s capabilities and functions.

How ALFA Works: Maximizing Returns, Minimizing Effort

Imagine having a tireless assistant that continually monitors the WALBING Marketplace and makes strategic purchases based on your investment criteria. ALFA does just that. By harnessing the power of advanced algorithms, ALFA considers your specified investment parameters and instantly assigns receivables to your portfolio, efficiently utilizing your investment capital.

While ALFA goes above and beyond by acquiring receivables that perfectly match your requirements, you retain a complete control over your portfolio, setting parameters that allow for diversification and risk management while maximizing returns and saving you time and effort.

Easy Configuration: Tailor ALFA to Your Investment Goals

ALFA isn’t just a one-size-fits-all solution. It empowers you to customize and configure its functionality to align with your investment objectives. Let’s take a closer look at the simple configuration process:

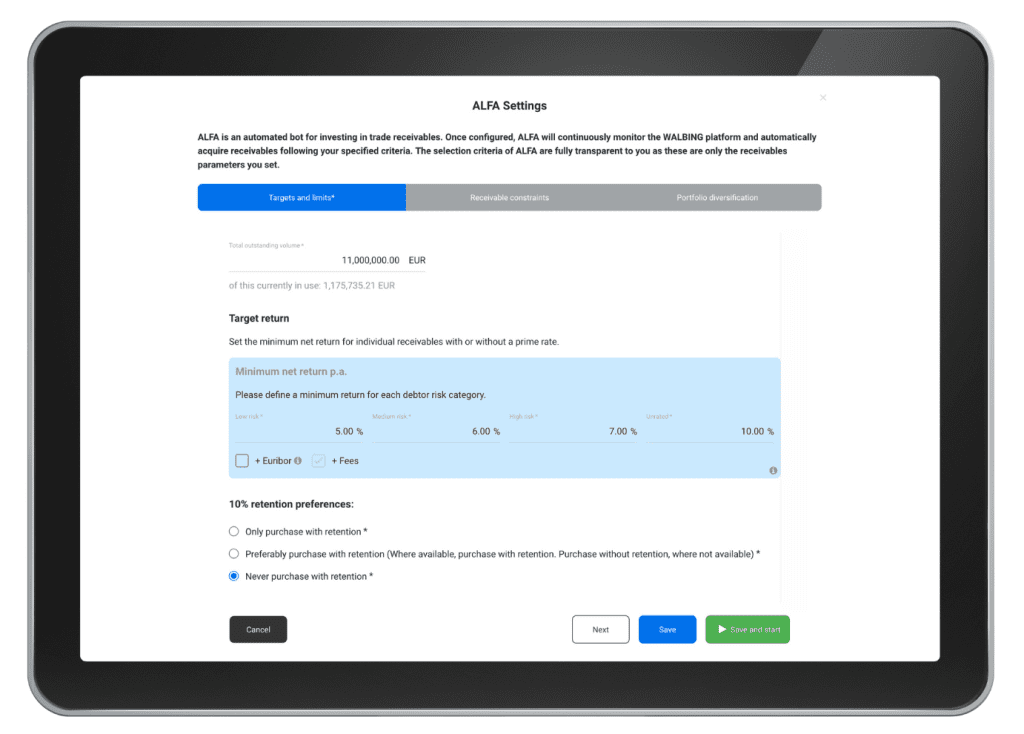

Step 1: Set Targets and Limits for Optimal Performance

Get started by defining your portfolio’s target volume and return. The target volume represents the maximum investment amount you’re comfortable with, including fees, while the target return sets the minimum return you expect for each receivable. Additionally, you can define the target return for each risk class, including low, medium, high, and unrated. With these foundational targets in place, ALFA knows exactly what you’re aiming for.

Step 2: Fine-tune Your Investment Strategy

Now that you’ve set your targets, it’s time to further detail your investment requirements. The RECEIVABLE CONSTRAINTS tab allows you to filter receivables based on various factors such as ticket size, assignment type, risk class, payment term, debtor company, industry, and country. Fine-tuning these filters ensures ALFA selects receivables that check all your boxes.

Step 3: Achieve Portfolio Diversification and Manage Risk Effectively

Diversification is key to a successful investment strategy. ALFA understands this and provides a PORTFOLIO DIVERSIFICATION tab where you can set limits on outstanding amounts per debtor, country, industry, and more. By combining general limits with special conditions, you can create exceptions and ensure your portfolio remains well-diversified. Limiting risk has never been easier.

How ALFA Makes Purchasing Decisions

ALFA isn’t just an algorithmic bot. It’s an intelligent decision-maker backed by extensive data analysis. Before ALFA was even configured, it takes into account your entire portfolio history, including manual purchases made in the past. This historical data informs ALFA’s purchasing decisions, ensuring optimal coverage of your target volume.

But here’s an intriguing question: What happens when multiple investment portfolios qualify for the same receivable? ALFA has the answer. It cleverly selects the portfolio with the highest unutilized target volume at any given moment, making the most of each investment opportunity.

Unlock the Investment Potential of Trade Receivables with ALFA

Our groundbreaking technology revolutionizes how we approach investment decisions in trade receivables. ALFA’s ability to assign receivables in real time, acquire perfectly matched receivables, and optimize portfolio diversification puts our investors in the driver’s seat.

By leveraging ALFA and its straightforward configuration process, investors can effortlessly scale their investment in trade receivables. With ALFA as your automated assistant and the ultimate alternative asset matchmaker, you’ll witness a new level of efficiency, enhanced decision-making, and improved profitability.

Don’t keep your investment strategy on the sidelines. Embrace ALFA and unleash the full potential of your investment journey on the WALBING Marketplace!